COVID-19 aid invoice features PPP financial loans for Wisconsin’s hotel marketplace

COVID-19 aid invoice presents PPP loans for Wisconsin’s resort marketplace

The COVID-19 relief monthly bill improves the dimensions of PPP loans to 3.5 situations payroll and will make forgiven PPP financial loans tax-deductible when quickly enabling whole deductibility for business enterprise meals.

MILWAUKEE – The COVID-19 aid bill is bringing some a lot-desired aid to Wisconsin’s having difficulties resort field.

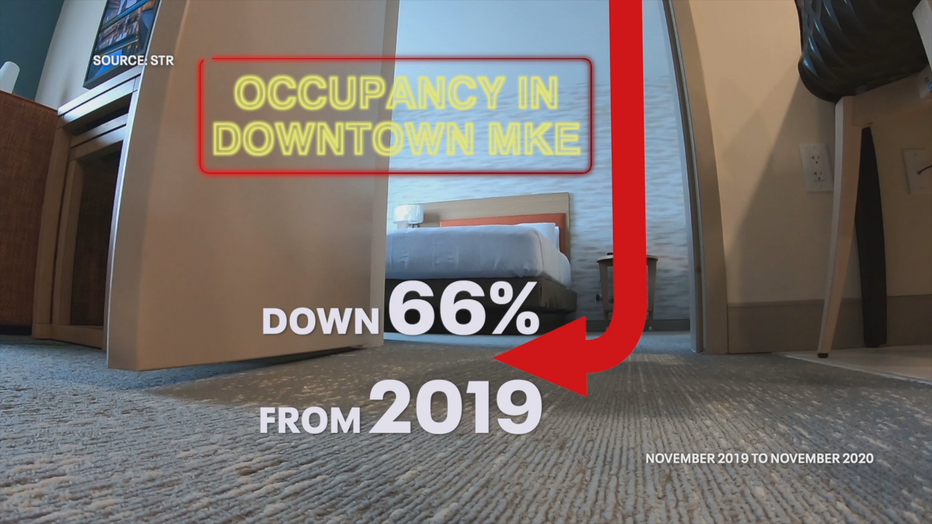

Resort occupancy yr-to-date was 37% at the stop of November in Wisconsin, in comparison to 57.8% in November 2019. With no extra federal aid, numerous accommodations noted experiencing closure.

The Tru by Hilton and Residence2 Suites by Hilton facility in downtown Milwaukee has been employing a skeleton crew since its opening just 4 weeks in the past. Its occupancy has ranged from 10% to 25%.

“Amongst the 31 accommodations that are downtown, we’re battling for scraps,” said Kevin Dombrow, space director of gross sales for Hawkeye Motels.

Hawkeye Inns opened five of its 6 Wisconsin accommodations in 2020. The opening ideas have been established in motion in far better periods.

“In 2019, we ended up shattering documents,” reported Dombrow.

Occupancy in downtown Milwaukee is down 66% when compared to 2019, in accordance to STR. Ordinary day by day costs are down $45.

“To set it in a nutshell, our marketplace has been devastated by the pandemic,” stated Monthly bill Elliott, of the Wisconsin Hotel & Lodging Association (WH&LA).

Elliott states 53,000 lodge-supported work ended up in jeopardy without extra federal reduction.

“We’re extremely, quite concerned about our market and preserving our persons employed and our organizations open up,” claimed Elliott.

Survey on business

In a November survey conducted by WH&LA, 47% of certified Wisconsin accommodations and lodgers stated they’d near inside of six months without far more federal funding.

“We’ve acquired a extended road forward of us to dig out of the mess that the pandemic has prompted,” reported Elliot.

So significantly, Paycheck Protection Plan (PPP) loans and $20 million in CARES Act grants have retained the lights on at quite a few Wisconsin inns. The new aid bill presents a 2nd spherical of PPP Loans, but Elliott hopes extra can even now be accomplished.

“There are a good deal of diverse varieties of tax relief that would really assistance us,” said Elliot.

Any relief for the inns alongside Lake Michigan is basically a daily life-preserver till journey for leisure and corporate company resumes.

“Company travel most likely isn’t going to resume right up until July or August,” claimed Elliot.

When requested about community wellbeing fears, Dombrow suggests Hawkeye’s lodges are extensively cleaned, with rooms sealed just after housekeeping visits and commons parts commonly disinfected.

“Another person is heading to be touching factors up each individual 15 minutes. Especially elevators, elevator buttons, typical surfaces, tables,” explained Dombrow.

The new aid monthly bill increases the dimension of PPP Loans to 3.5 times payroll and can make forgiven PPP Loans tax-deductible. It also quickly allows whole deductibility for foodstuff and drinks for small business food expenses.

The WH&LA calls the monthly bill a “significant step” which is “extended overdue.” The association will go on operating with elected officers in hopes of extended-term aid.

Totally free Obtain: Get breaking news alerts in the FOX6 News app for iOS or Android

Full assertion from Bill Elliott of WH&LA

“This PPP laws was a critical action toward encouraging Wisconsin’s hospitality marketplace survive as the pandemic persists. We are grateful that Congress has passed this extended-overdue reduction, and we glance ahead to doing work with our elected officials at both of those the point out and federal level on longer-expression relief methods that will aid to ensure the long term of Wisconsin’s tourism field.

We are hoping for long term Congressional motion about targeted tax provisions. Via the American Resort & Lodging Association, we are encouraging Congress and the Administration to assist our sector and our staff by like qualified tax provisions in long term legislation that will benefit seriously injured companies and their staff members, which includes tax credits for capital expenses or charges to satisfy the industry’s Protected Stay initiative increased Personnel Retention Credit (ERC) and a temporary journey tax credit.”